For most Americans, the Social Security benefits are something they work toward throughout their lives. It’s one of the main ways for someone to secure their retirement. So, when someone calls you pretending to be from the Social Security Administration (SSA) regarding an issue, worry takes over you, and you start believing whatever they say.

That’s how a significant chunk of the American population gets scammed every year. To avoid getting scammed, you should know about the common scams like the Social Security scam email and others like it.

At the same time, you should also know what to do if a scammer pretending to be Social Security asks for the money back. In this article, we will also discuss some tools, like Searqle, that help to some extent in avoiding scams.

Top Five Social Security Scams

Let’s look at these scams and how they work without further ado:

Your SSN Is Tied to a Crime

The most common scams are the ones that play on people’s fears. In this case, a scammer might call you, telling you that your Social Security Number (SSN) is involved in a crime.

There are different variations of this scam. Occasionally, the scammer will inform you that the SSA has suspended your SSN and that you need to renew it. They ask for your current SSN and PIN to verify your identity, stealing your information and money.

They might attempt this over the phone or send you a Social Security scam email to obtain the information.

There are also cases where the scammer pretends to be an SSA customer representative and asks for a fee to reactivate your account. In these cases, they’re attempting to have you reveal your SSN so they can use it for themselves.

The “You’re a Victim of Identity Theft” Scam

Although ironic, identity thieves will sometimes contact you to tell you that you’re a victim of identity theft. You might see a Social Security suspension email or get a call directly.

Compared to the criminal charge scam, the approach is different. However, the way this scam works is the same. The scammer gets in touch with you and creates an entire story about identity theft and how they will help you get through it. Eventually, they will either ask you to reveal your old SSN or have you pay a fee to resolve the issue.

Promises for Unknown Social Security Benefits

Sometimes, scammers use greed and trust as powerful motivators instead of playing on your fears. In this scam, you might get called about increased benefits you have yet to learn about.

They always want to make it appealing to the victims. It is why the scammers will try to make the process appear as simple as possible. For security reasons, they’ll claim you only need to verify your identity and SSN. By now, you should’ve realized that these are the same lines used by scammers for their other attempts.

Request to Return Overpayments

Out of all the scams on the list, this is the most alarming one. That’s because it comes with the warning of paying fines, facing legal charges, and sometimes jail time.

The way this scam goes is that you’ve “allegedly received” payments from some government agency. And now, the representative from Social Security asking for money back. They urge you to do it soon because the alternative is you dealing with legal trouble, which you’re always going to try to avoid.

Scams Via Emails, Text Messages, and Letters

Social Security scams aren’t exclusive to happening over the phone. We’ve previously mentioned emails. But occasionally, you might be dealing with Social Security letter scams. These will tell you to call a number to resolve “the issue” that has arisen.

These letters might also contain a link you can access from your computer. However, when you visit the link, you compromise your passwords and login credentials, putting yourself at risk. In some emails, the sender might send malware through the link, which gives them a backdoor to your computer with complete access.

They do, if you’re wondering, “Does Social Security send text messages?” However, this occurs if you’ve opted to receive such messages. They will never send a text asking you to reply with your SSN. Now that you know this, you can be careful the next time you get an SMS from the SSA.

How Often Do Social Security Scams Occur?

After reading about the cases of Social Security scams, you might be thinking that it’s easy to spot these scams. So, does it happen that often? The short and simple answer is yes.

Every year, America loses millions of dollars to these scams, making it a massive deal among the people. It’s common to assume that older people are the most common victims. However, people in their 30s and victims typically fall into these schemes and end up losing money to these attackers.

From 2018 to 2020, SSA imposter cases rose from around 15,000 to over 700,000. While it’s improved over the years, it’s not going away anytime soon. That’s why you need all the details: “How do I know if an email from Social Security is legitimate?”

Why Are Social Security Scams So Effective?

So, why do Social Security scams work? It’s because the scammers play on human emotions. They use a combination of urgency and fear to get the victims to do what they want. When they contact you, pretending to be from a government authority, you feel inclined to believe them.

You think they know what they’re discussing when they use their complex bureaucratic terms. But all they’re trying to do is confuse you. They assume and treat you as if you know nothing about these things, and they approach you calmly and soothingly to win you over.

You already know that a scam call is always more effective than a Social Security letter scams. It works because scammers use caller ID spoofing. It sends a fake signal to the victim’s phone, making it easy for them to pretend to be someone local and trustworthy.

However, the reality is that these scammers could be trying to contact you from practically anywhere.

Recognizing a Social Security Scam

You must recognize the signs to protect yourself from a Social Security scam email or a fake caller. While each scammer operates slightly differently, here are some common signs you can use to identify an attempt to scam you.

Threats of Suspension

An actual SSA employee would never call you to threaten that your account will get suspended if you don’t do as they say. If you see that they’re asking for your SSN over the phone, that’s an obvious sign that they’re trying to steal from you.

Request for Payment or Service Fees

Even if you get a call from the SSA, they will never ask you for any payments or fees simply for talking and getting their help. Remember that the company employs them, and they don’t rely on customer payments to make a living.

Request Information to Increase Benefits

While it’s possible to get increased benefits in exceptional cases, you won’t be asked to reveal sensitive information over the phone or send it in a reply to Social Security letter scams. It’s a standard scheme to ask for your SSN information so that scammers can enjoy your benefits.

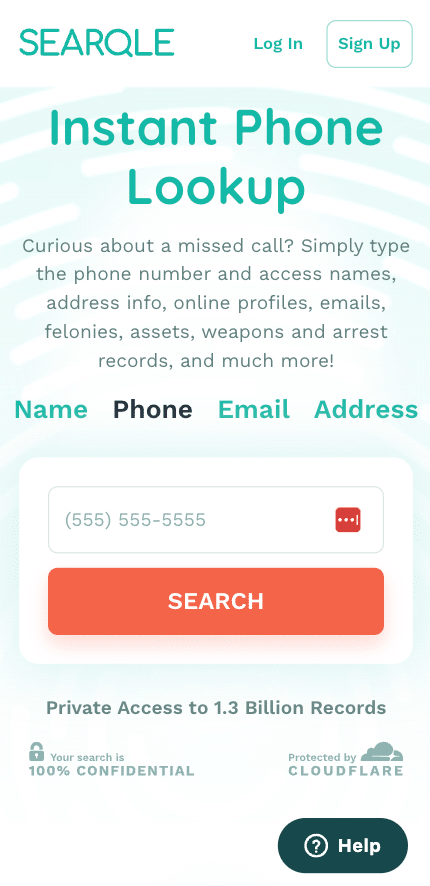

If you notice any of the above in any communications from the SSA, you should consider using phone lookup services to check whether it’s a scammer. A service like Searqle works perfectly, as you can look up phone numbers and email addresses to find out who they are.

What to Do in the Event of a Potential Scam

Now that you know how to identify a scam, you need to know what to do to get out of it. You don’t need to go out of your way to do anything. There are some simple steps that you can take to protect yourself.

If you get called by a scammer, the first and most obvious thing to do is to hang up. Don’t engage with them, don’t give them your name, and above all else, don’t answer any of their questions. So, the best course of action is not doing anything.

If you’ve received a text or a Social Security scam email, don’t click on any suspicious links. As we’ve explained, these can be phishing attempts to access sensitive information. Ignore the message and have nothing to do with it.

Lastly, you need to report it to the relevant authorities. Call the SSA directly at 800-772-1213 to inform them of your situation. You should also notify the Office of the Inspector General. The FTC also has a fraud reporting site where you can do the same.

By learning more about your situation, they can use the information to protect others.

Things to Do If You Fell for the Scam

But if you did fall into the scheme of getting unknown Social Security benefits, you must stop blaming yourself and take the following steps:

It starts by reporting the incident to the relevant authorities and asking for assistance.

While at it, you should also report the incident to the FTC’s Identity Theft website. They will help you with the next steps you need to take to recover some lost money or minimize the damage in the worst-case scenario.

You must learn from your mistakes if you were unlucky enough to fall victim to the scam. You have to take the proper steps to ensure it doesn’t happen to you or anyone else you care about in the future.

Wrapping Up

This article has helped you identify Social Security scam emails and avoid falling victim to them. Now, you know how to protect yourself from potential scams. If you ever suspect a caller or an email to be a scam, rely on services like Searqle to get additional information to help you get out of these schemes.